To avail of tax benefits business owners need to deposit the requisite amount in a specified Deposit Account or Special Account. The following income of an assessee shall be classified and computed under the head Income from other sources namely-.

Federal Income Tax Changes Married Filing Jointly Tax Brackets Federal Income Tax Income Tax

INCOME TAX By taxconcept December 16 2019 April 5 2020.

. 47 of 1967 Date of coming into operation. 2 Chapter 2 provides for entitlement to a personal allowance and a blind persons allowance. As per Section 33AB of the Income Tax Act if a business owner engages in manufacturing and cultivating coffee tea and rubber they are eligible for tax deductions.

1 Where the Comptroller is satisfied that the purpose or effect of any arrangement is directly or indirectly a to alter the incidence of any tax which is payable by or which would otherwise have been payable by any person. PART III - ASCERTAINMENT OF CHARGEABLE INCOME Chapter. Interpretation of section 33.

The scheme and purpose approach is as follows. A dividend and interest. Income Tax Act Part.

Chapter 4 - Adjusted income and adjusted loss Section. Chapter 4Adjusted income and adjusted loss 33. 10 charge of income tax 10a profits of unit trusts 10b excess provident fund contributions etc deemed to be income 10c income from finance or operating lease 10d ascertainment of income from business of making investments 10e ascertainment of income from certain publicprivate partnership arrangements 10f ascertainment of income from.

1 a in respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of this section and of section 34 be allowed a deduction in. B an assessee who installs any machinery or plant other than office appliances or road transport vehicles which before such installation by the assessee was used outside india by any other person shall subject to the provisions of section 34 also be allowed as a deduction a sum by way of development rebate at such rate or rates as may be. Notwithstanding anything contained in this act or any other law for the time being in force where any supply is made for a consideration every person who is liable to pay tax for such supply shall prominently indicate in all documents relating to assessment tax invoice and other like documents the amount of tax which shall form part of the.

Income from other sources. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting. General provisions as to valuation of benefits.

Section 33 1 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1. Persons on whom tax is to be collected. 33 See rule 43 Folio No.

10 See the Malaysian decision of Comptroller of Income Tax v. And if so ii consider whether the taxpayer may avail himself of the statutory exception. I consider whether an arrangement prima facie falls within any of the three threshold limbs of section 331 such that the taxpayer has derived a tax advantage.

Tax on income of certain resident co-operative societies Section - 115BAC Tax on income of individuals and Hindu undivided family Section - 115BAB Tax on income of new manufacturing domestic companies Section - 33AB Tea development account coffee development account and rubber development account 6 Record s Page 1 of 1 in 0 seconds. In short when you spend money to earn money youre allowed to deduct that cost from the income. 1 3 a in respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of this section and of section 34 be allowed a deduction in.

In view of the recent disturbances in the North Eastern region of India CBDT has decided to extend the date for payment of 3rd installment of Advance Tax for FY 2019-20 from 15th December 2019 to 31st December 2019 for the North Eastern Region. Section 33 is as follows. ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1.

Basis period to which gross income from a business is related. Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income1. Section 33 1 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1.

C income from letting of machinery plants or furniture belonging to the assessee and also of buildings. Section 33A 3 of Income Tax Act The deduction under sub-section 1 shall be allowed only if the following conditions are fulfilled namely i the particulars prescribed in this behalf have been furnished by the assessee. 33 Overview of Part 1 This Part provides for personal reliefs.

B royalties and fees for technical services. Income Tax 5 Section 23. INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

In short when you spend money to earn money youre allowed to deduct that cost from the income. In short when you spend money to earn money youre allowed to deduct that cost from the income. Personal relief and relief for children.

ACT 53 INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002. What is Section 33AB of the Income Tax. Short title and commencement 2.

Interpretation of sections 24 to 28 24. Personal Income Tax Act CHAPTER P8. Clearance certificate under the first proviso to sub- section 1A of section 230 of the Income-tax Act 1961 GOVERNMENT OF INDIA Full name in block letters Name of father or husband Permanent Account Number or Aadhaar Number Passport NoEmergency Certificate No.

Ascertainment of chargeable income.

Alert Companies Have Started Issuing Form 16 To File Your Taxes Have You Received Yours Click On The Image To Know Why You Ne Income Tax Income Employment

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

12a And 80g Renewal Society Trust Renew

Taxtips Ca Business 2020 Corporate Income Tax Rates

Pin By Vipin Kumar On Vipin Kumar Coding Qr Code Enhancement

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

Form 33 Clearance Certificate Online Taxes Filing Taxes Tax Services

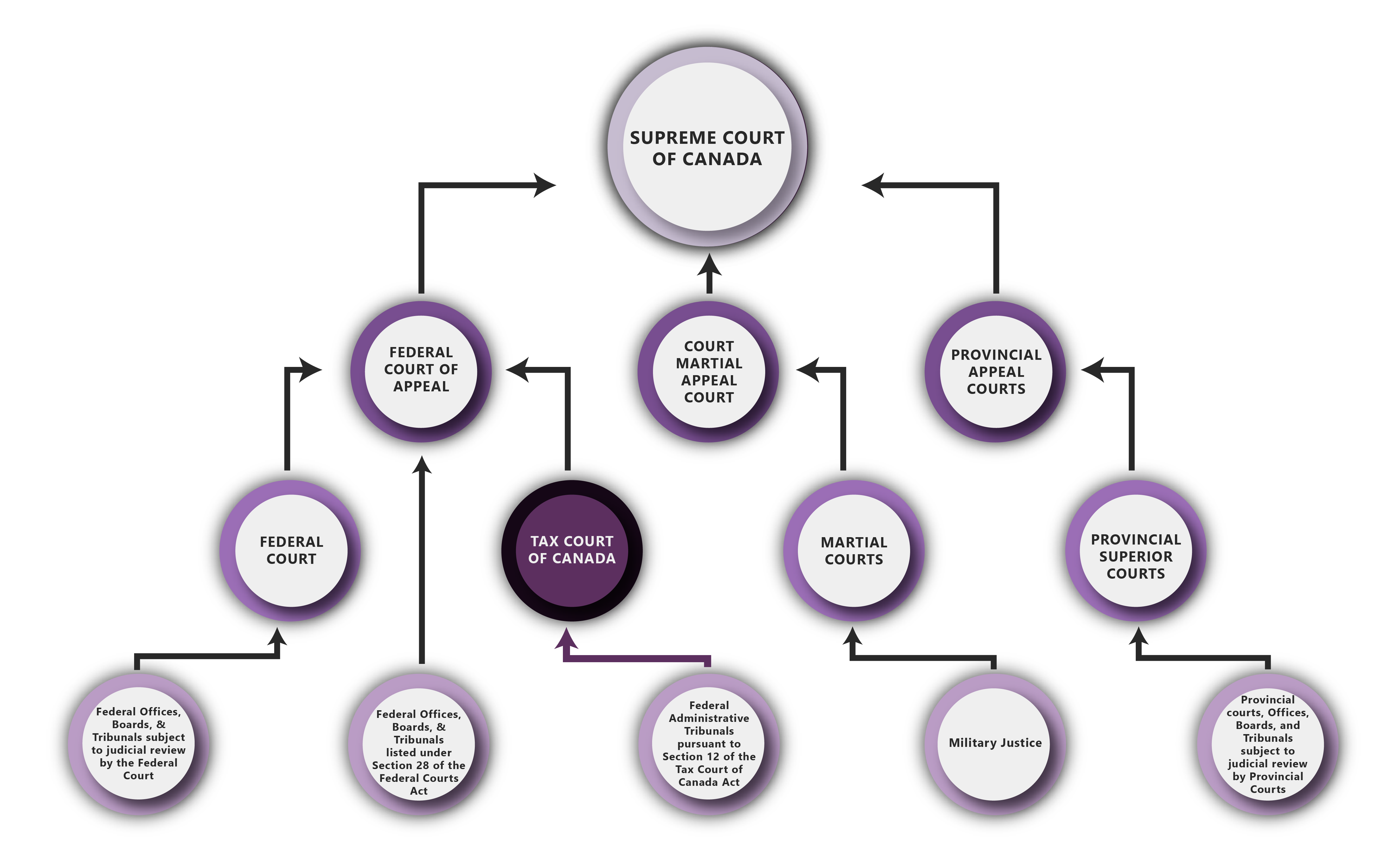

Tax Court Of Canada Jurisdiction

Fourth Grade Sol Study Guide Study Guide Teacher Guides Owners Manuals

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Genesis Of The Indian Taxation System Small Business Tax Business Tax Tax Refund

See For Yourself My Fellow Nigerian Follow Aniomablog On Ig And On Twitter Aniomablog Mirrored Sunglasses Men Mirrored Sunglasses News Video